Vol 133: Artists & DSPs, Netflix Data, Industry Layoffs, Metallica, and More

Making sense of DSP & Artist relationships; diving deep into Netflix' data, and Spotify layoffs, and some good old fashioned hypocrisy from Metallica.

How DSPs are Reshaping Artist Strategies

In the fast-evolving world of Digital Service Providers (DSPs), artists and their teams are exploring groundbreaking avenues (sometimes willingly, sometimes not) to enhance fan engagement and monetization. This deep dive uncovers the latest trends in DSP features, from profile customization to advanced data analytics, offering a glimpse into the future of music and technology.

Artist Wish Lists: Replies to a tweet from Spotify product leader Chris Stoneman back in January 2023 revealed several features artists would like to see added to their platforms and public profiles:

Full album and track credits — TIDAL, Qobuz, Apple Music on mobile, and YouTube Classic display these now.

Ability to display music on profiles as a secondary artist — an issue relevant to remix producers and featured artists.

Search function to filter releases by a record label — hinting at potential label pages following the recent Spotify for Labels analytics rollout.

Native “pre-save” function for new releases (currently, third-party services are the only way for artists to enable fans to “pre-save” releases in advance).

Innovative Fan Engagement: DSPs are creatively bridging the gap between artists and fans. Amazon Music integrates Twitch for live streaming notifications, while Spotify's ‘Clips’ feature allows artists to share short video messages. These tools are redefining fan interaction.

Market Trends and Predictions:

Streaming Payout Models Shift: Spotify's new royalty payment structure may significantly influence most artist’s revenue streams.

Social Media and Music: Platforms like TikTok and Instagram are stepping into the music arena, offering unique features for music discovery and fan engagement. This trend points to a continued shift in how music is marketed and consumed.

TikTok’s distribution service SoundOn is the only way for artists to get detailed first-party analytics on how their music is utilized on the social app.

Recently launched features for profile customization and fan engagement on TikTok include Add to Music App, which allows fans to save songs discovered on the app to the streaming service of their choice, and verified artist accounts, which allow artists to display their catalog of music as “official TikTok sounds” and highlight specific videos that utilize their music.

TikTok is testing its own paid DSP, TikTok Music, in select markets including Indonesia, Brazil, Australia, Mexico, and Singapore.

ByteDance is currently testing an AI-powered music creation and audio editing app called Ripple in closed beta.

Rise of Niche Streaming Services: Services like Boomplay and Audiomack are catering to specific genres and communities, providing artists with platforms to reach targeted audiences more effectively.

Generative AI's Influence: The emergence of generative AI in music is stirring discussions (and debates) around streaming fraud, content moderation, and the evolving definition of an artist. How major DSPs adapt to this trend will shape the industry's future.

Industry Layoffs: Staff reductions across major DSPs could impact the rate of feature development and artist support.

December 7, 2023: Tidal announced they were cutting 10% of staff, as part of parent company Block’s plans to cap their total headcount at 12,000 employees.

December 4: Spotify announced a deep cut of 1,500 employees, or 17% of their workforce. Their Chief Financial Officer and head of marketing are both departing in the coming months.

November 9: Amazon Music announced layoffs across their editorial and audio teams, which we believe also impacted some of their FA staff specifically. Interestingly, the Head of Amazon Music for Artists also took on a new role as Head of Fan Commerce — which may indicate Amazon would like to generate more revenue from taking a cut of artists’ merch sales, versus focusing on improving artists’ presence within their streaming platform.

October 17: Bandcamp laid off 50% of the company, including several editorial and support staff, as part of their controversial sale from Epic Games to Songtradr.

About Those Spotify Layoffs

I have some additional thoughts on the layoffs, and why I don’t personally believe they’ll be that consequential to the platforms and user/artist experiences.

A Heavy Mental reader replied to last week’s update with the following:

It's funny that the people who actually made the mistake of overhiring aren't impacted by the layoffs

They never are… but Spotify was the most bloated org I’ve ever seen. Fun, but bloated. Senior leaders were incentivized to grow like that in the name of The Spotify Model which, in retrospect, had so many flaws and had this damaging side effect. N-dimensional matrices, infinite handovers, and non-functional requirements such as “pseudo-scalability” and “culture.”

Don’t get me wrong, I also drank the Kool-Aid, but it felt wrong, and unproductive. Maybe they’ve finally had an epiphany.

The Spotify Model

Spotify's growth model is very challenging because all the pressure for revenue growth is on acquiring new customers. Their existing customers churn and those that stay don't expand (a common problem in the B2C model). This results in Net Dollar Retention being less than 100%. Since they're continuously losing revenue from their existing customer base, they need to constantly acquire new customers not just to grow year-over-year, but also to compensate for the loss in existing revenue. This situation is difficult, and their options for expansion are limited (with only the family plan available), which leaves them with another unpopular choice: increasing prices.

They did raise prices for existing users, which provided some short-term relief. However, this is a temporary solution, and the clock is ticking. Once the price increases reach the one-year mark, growth will slow down again. This is because they will lose the benefit of favorable, 'unfair' year-over-year revenue growth, which was initially boosted by higher prices this year compared to lower prices last year.

Cutting back on marketing isn't an option; they need it to bring in new users. So, the next big thing they can cut costs on is their workforce.

What's the big picture here?

Well…

1. The tech world is changing. It's not just about growing as fast as possible anymore (thank god). It's more about intelligently building a business that can sustain itself in the long run (yay!).

2. Gone are the days of growth unicorns - we're going to hear a lot more talk about actual profits in the tech industry.

3. How much revenue each employee brings in is going to become an important metric.

4. As an employee, know how the work you do contributes to the bottom line. Yes, even if you are Product Manager (especially if you are a PM!).

5. Unfortunately, we will continue to see more layoffs and excuses of “we over hired because money was cheap in 2020-2021.”

Human Rights are so Overrated

Global Citizen, the organization that fights to end poverty, while promoting justice and equity, has twice hosted Metallica at their annual Central Park concert, and published this article on the band’s generosity.

Human Rights Watch has a plethora of content detailing the atrocities in Saudi Arabia, and Global Citizen has also dedicated a sizable chunk of their site (23 pages and counting) detailing the endless abuses in the country. Imagine their surprise when Metallica dropped a surprise announcement that they’re going to perform a concert in Saudi Arabia.

Maybe I’m overreacting. What’s a few beheadings amongst friends, and surely it makes sense to give someone a death sentence for what they tweet, and do women really need to be without male guardianship?

Bonus: They’ll share the stage with famed women’s rights advocate, Chris Brown. Who, of course, is also on the bill.

Will Global Citizen renounce the band? Will Bono ever return Lars’ texts?

Fortnite gets the (Rock) Band back together

Two years after Epic Games acquired game developer Harmonix, music video game Rock Band is regrouping in Fortnite as a new mode called Fortnite Festival. It’s bringing the classic game to a new generation of fans with a global social-playing aspect, but may also help build the underlying technology for musicians to play real instruments during in-game concerts.

Fortnite Festival lets users play the game in two ways — the classic notes-on-a-treadmill main stage format and a “jam” format that allows up to four players to mix-and-match instrument parts from different songs.

The jam format is new, letting players adjust tempos and scales to create original remixes or opt into Battle Royale mode to start bands with other users.

The game will operate in “seasons” headlined by talent — the first season’s headlining act (alleged talent) is The Weeknd.

There’s also a marketplace called “Festival Pass,” where users can unlock songs, skins, and other accessories.

The game has cross-console compatibility, meaning players using an Xbox controller can play with someone using mobile — and the trademark instrument controllers will be launched soon.

Teens use social media almost constantly

Pew Research compiled its latest social media-centric study by querying 1,453 respondents between the ages of 13 and 17. The data reveals insights into Gen Z’s social media habits—and the platforms that rule their online lives.

Here are a few of the highlights:

Teens are online pretty much all the time. 46% of respondents reported that they use the internet “almost constantly.” Much lot of that activity is on TikTok: according to Pew, the Bytedance-owned app is the platform used “almost constantly” by the greatest percentage of teens (17%).

YouTube still has the widest reach among teens. 93% of respondents reported regularly using YouTube, while 63% said the same of TikTok. Snapchat and Instagram were next in line (but among those four platforms, only Snapchat saw its usage percentages rise).

WhatsApp and Facebook scored very minor gains. In addition to Snapchat, WhatsApp and Facebook saw their usage go up slightly, but teens reported they used Facebook almost exclusively to access Groups — just like me! Discord and BeReal (both of which are newer additions to Pew’s research studies) also claimed significant shares, although BeReal saw drops each month.

Reminder: Next year, Gen Alpha joins the ranks of teenagers.

Check out Pew’s full four-page report here.

The Netflix Data Dump

Netflix released a report covering the viewership metrics of 99% of its catalog (roughly 18,000 original and licensed titles). While Netflix has historically been more transparent than its rivals, a report of this magnitude from the top platform is a paradigm shift for Hollywood and will likely force every other streamer to follow suit, reshaping the conversation of what defines a “hit.”

The searchable spreadsheet breaks down projects by title, hours viewed, release date, and whether a title was released globally.

Netflix Originals dominated the list, 55% of viewing was for Originals, while 45% was for licensed titles.

Netflix’s Top 10 and Most Popular lists now break down metrics by “views” (to not overly favor long drama shows), co-CEO Ted Sarandos said that this report still gives a clear view of how titles are doing on the platform.

Netflix claims the Hollywood strikes weren’t the reason to finally become this transparent about data, they acknowledge that the culture of keeping viewership details close to the chest was responsible for “creating an atmosphere of mistrust over time.” The strikes made that loud and clear.

There is a lot of data here to unpack, and there is no country-level data, distinguishing between movies and TV shows, overall show level (as opposed to season level) numbers, or whether or not a movie or TV show is a Netflix original. The data also only covers January-June 2023, and is not cumulative.

However… Netflix said they will provide more extensive data to content creators.

In other words, it is very hard to pull out clear insights from this data, without doing massive amounts of grunt work.

But I can contextualize the data provided in a way that hopefully is easy to digest.

Power Laws

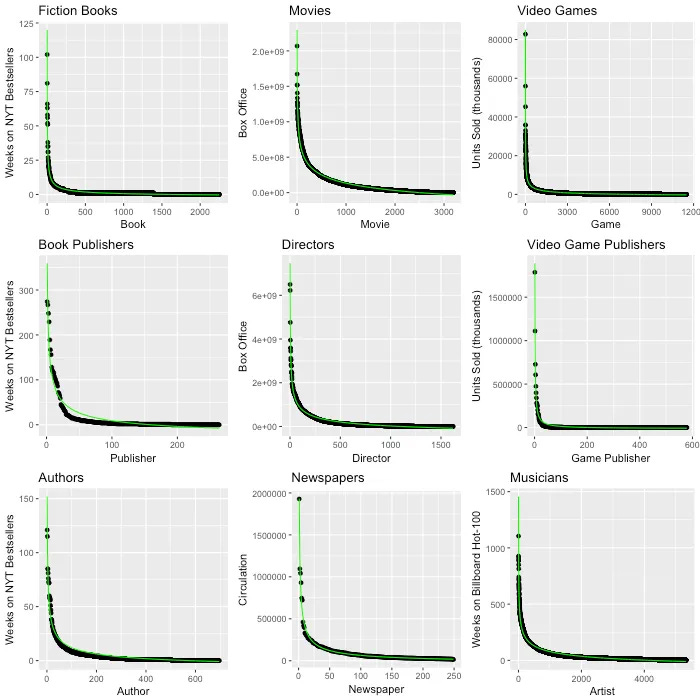

That, right there, is a picture of the Internet: power laws rule everything.

Most of what I read is the best there is to read on any given subject. The trash is few and far between, and the average equally rare.

This is made possible by the glorious Internet. No longer are my reading choices constrained by time and especially place. Why should I pick up the Wisconsin State Journal — or the Taipei Times — when I can read Nate Silver, Ezra Klein, Bill Simmons, and the myriad experts a tap away? Everyone interested in news, politics, or sports can read the best with less effort — and cost — than it ever took to read merely average content just a few years ago.

This reality applies to almost everything; Michael Tauberg pulled together this set of charts in a 2018 Medium post:

From Tauberg:

Looking at these graphs, the same question jumps out with each one -why power law? What is it about media that results in this concentration of success? The short answer: network effects and positive feedback loops. Both concepts are described well by David Easley and Jon Kleinberg in their book “Networks, Crowds, and Markets: Reasoning about a Highly Connected World”. In particular, they posit that popularity is a network phenomenon.

It’s easy to see how this might play out in our examples. In our networked world, people can recommend books, movies and games to each other. These titles will get more reviews, more shelf space, and ultimately, more attention. In this way, success breeds success. It’s a virtuous cycle, a positive feedback loop. The popularity of one work takes attention away from others. It crowds out other media just as giant trees crowds out smaller plants. This process is called preferential attachment and it is at the heart of power law.

—

Quality is the independent variable that is consistent across power law distributions. Network effects and algorithms definitely matter, we’ve seen them make bad content popular. But I would go further: I think it’s unlikely that exceptional quality stays buried for long (although the speed of its discovery and magnitude of its reach does depend on the underlying liquidity of the market).

FINALLY…

I think Netflix released this data not in reaction to the Hollywood strikes, but to be THE place to distribute content. The company’s Letter to Shareholders emphasized Netflix’s ability to drive engagement via its “reach, superior recommendations and intense fandom”, and tied that capability to how it made a hit out of Suits.

Netflix refers to “opportunities to license” and the opportunity to “deliver additional value for our members”, concepts that make sense to investors. What this section really reads as is a letter to other Hollywood Studios: for how long will they persist in under-monetizing their content on subscale streaming services that are costing them a fortune to run, and even more when you consider the cost of customer acquisition and churn mitigation?

The orgs that will absolutely be doing the grunt work to understand these numbers are studios looking up all of the TV shows and movies they have licensed to Netflix to understand just how big are the audiences they have — or could have — if they put content into the most liquid market there is.

THE NEWS DESK

No No: The Go-Go's guitarist Jane Wiedlin is one of six women who now say that famed DJ/club owner Rodney Bingenheimer molested them when they were underage.

Forever Green: How Much Money Does Brenda Lee’s ‘Rockin’ Around the Christmas Tree’ Make? A lot.

Deep Trouble: X’s revenue expected to drop to $2.5 Billion, almost half of what the company did the year before Musk’s purchase.

The Year of AI: Dictionary.com names “hallucinate” as its Word of the Year, thanks to AI giving the word new meaning.

Not Cheap Sunglasses: Meta Ray Ban smart glasses will understand visual inputs and let users ask the glasses questions about their surroundings.

Transparency is Overrated: YouTube removed a snippet of code that publicly disclosed whether a channel receives ad and subscription payouts, obscuring which creators benefit most from the platform.

New Math: This right here is exactly how Spotify’s new 1,000 annual streams royalty policy works.